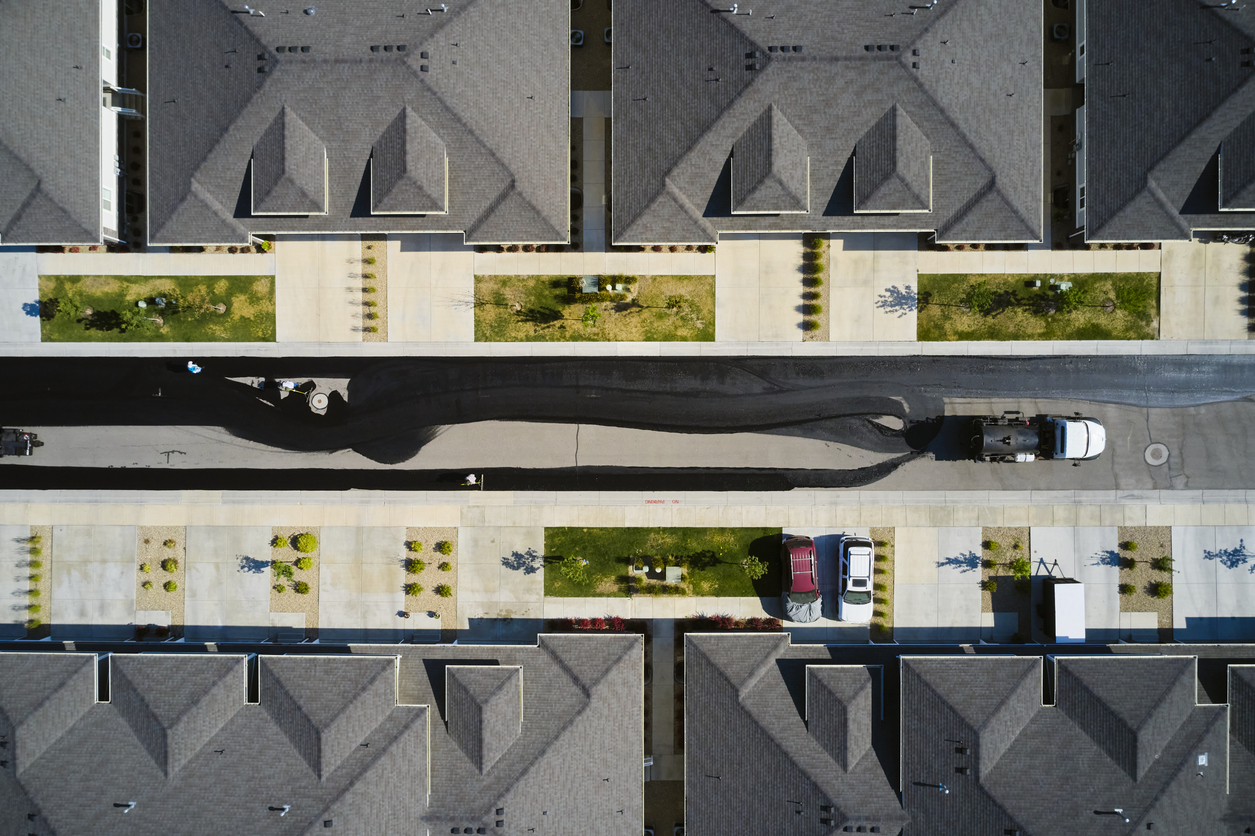

Paving contractors face a unique set of risks that require comprehensive insurance coverage. From equipment damage to liability issues and worker safety, the right insurance policies can safeguard against potential financial losses.

Here’s a look at five essential insurance coverages every Utah paving contractor should consider.

1. General Liability Insurance for Paving Contractors

General liability insurance is vital for paving contractors, covering property damage and bodily injury to third parties. This insurance protects against claims arising from accidents or damages that occur on a job site.

For instance, if a pedestrian trips over construction materials and gets injured, general liability insurance will typically cover medical expenses and legal fees.

In Utah, there are minimum coverage and licensing requirements that contractors must meet. Ensuring adequate general liability insurance helps protect your business from significant financial burdens due to unforeseen incidents.

2. Commercial Auto Insurance

Paving operations rely heavily on vehicles such as trucks and other heavy machinery. Commercial auto insurance is necessary to cover these vehicles against collisions, theft, and other damages. This type of insurance ensures the protection of your vehicles, which are critical for daily operations.

Accidents involving company vehicles can lead to costly repairs and potential lawsuits. Having commercial auto insurance helps manage these risks, keeping your operations running smoothly without interruption.

3. Workers’ Compensation Insurance

Workers’ compensation insurance is essential for covering medical costs and lost wages for employees injured on the job. This insurance not only provides financial protection for your workers but also fulfills legal requirements in Utah.

Injuries on a paving site can be severe, from machinery accidents to falls. Workers’ compensation insurance ensures that employees receive necessary medical care and compensation, while also protecting the business from potential lawsuits related to workplace injuries.

4. Equipment Insurance

Specialized paving equipment is a significant investment and requires protection through equipment insurance. This insurance covers financial losses due to equipment breakdowns, vandalism, or theft.

For example, if a paving machine breaks down unexpectedly, equipment insurance can cover repair or replacement costs, preventing costly project delays.

Insuring your equipment means you can handle unforeseen issues without substantial financial strain, keeping your projects on track and within budget.

5. Umbrella Insurance

Umbrella insurance, or excess liability insurance, provides additional coverage beyond the limits of your primary insurance policies. For paving contractors, this type of insurance is crucial in scenarios where claims exceed the coverage limits of general liability, commercial auto, or workers’ compensation insurance.

For example, if a severe accident occurs on a job site resulting in extensive damages and legal claims, umbrella insurance can cover the excess costs, protecting your business from devastating financial impact.

Safeguard Your Business With Comprehensive Coverage

Each of these insurance types plays a critical role in protecting paving contractors from various risks. General liability, commercial auto, workers’ compensation, equipment, and umbrella insurance collectively provide a robust safety net for your business.

However, other coverages may also be necessary depending on specific needs. Working with an insurance professional ensures that you assess your requirements accurately and secure comprehensive coverage tailored to your operations.

For more information on securing the right insurance coverage for paving contractors, get a quote today.

About BTC Insurance Services

Founded in 2011, BTC Insurance Services has proudly served Utah businesses with comprehensive and custom-tailored insurance coverages for a decade. We pride ourselves on fostering long-term client relationships with a personalized and hands-on approach, and have established a reputation built on quality and transparency. For more information about our products and services, we invite you to contact one of our reputable agents today at (855) 944-3457, or send us a message here.