Winterizing Your Home

As we’re now in the middle of winter, we know that a variety of problems can arise during these months due to the weather. The importance of maintaining your home during these months can protect you from potentially large insurance claims. Start with the Roof Did you roof damage accounts for almost 50% of […]

Carbon Monoxide Safety Tips

With winter quickly approaching it won’t be too long before the freezing weather and snow are here. As the primary months when consumers crank up their furnaces and portable heaters, November, December, and January account for nearly two-thirds of all non-fire carbon monoxide (CO) related deaths. In fact, according to the Center for Disease Control, […]

Trampoline Safety

Trampolines are popular among children and teens and even among some adults. Though it may be fun to jump and do somersaults on a trampoline, landing wrong can cause serious, permanent injuries. Injuries can occur even when a trampoline has a net and padding and parents are watching. Common Injuries Thousands of people are injured […]

Pool Safety Tips

With summer quickly coming upon us, this means it’s time to lay out next to a pool, take in some sun, and just relax. Not to put a damper on that, but did you know that according to The Pool Safety Resource drowning is still the second-leading cause of death for children under age 14? So […]

Wedding Insurance

Summer is wedding season. However, planning a wedding can be a yearlong (or more) endeavor. And unfortunately, there are many things that can wrong on your big day — all of them outside of your control. With the average wedding now costing over $26,000, it’s important you don’t risk that investment getting potentially ruined. This […]

Personal Liability Insurance Coverage

We are often asked about what coverage is specifically provided by the liability portion of a homeowners insurance policy. We want to spend this post explaining what the coverage is and how it helps protect you. (Please keep in mind that every policy is different and that you should always refer to your specific policy […]

5 Strangest Cases of Insurance Fraud

Did you know that insurance fraud costs insurance companies (and ultimately consumers) more than $50 billion dollars each year according to the FBI? This equates to approximately $500 in increased annual premiums to each one of us. Plus, when you start adding in lost productivity for businesses, ruined family finances, and the cost to investigate […]

Does my credit score affect my insurance premiums?

What does my credit rating have to do with purchasing insurance? Everyone knows that credit scores are an evaluation of your payment history on a variety of consumer debt items like your home, credit cards, auto loans, etc. Credit scores are also used for a variety of other purposes such finding a place to live, […]

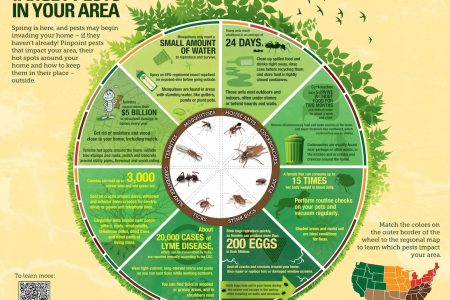

Insect Infestation Prevention

Did you know that insects like termites cause over $5 billion in structural damage every year? Even more important to note, though, is that most insect damage is NOT covered by your homeowners insurance policy. Most policies actually contain an exclusion that will not pay for damage caused by insects or rodents. It will, however, most […]

5 Strangest Insurance Policies Ever Written

Insurance doesn’t only just have to be for protecting your home, auto, family or your business. Insurance is available for protection against almost anything as long as it poses a potential financial impact and you are willing to pay the associated premiums. Below are five examples of the most unusual types of insurance policies ever […]